Yes. Yes, I feel really surprised by how much can one learn just with a regular consistent effort.

Right from knowing nothing about technical analysis to be astoundingly happy to claim that I understand the complexities of the above-mentioned graph really is an indication of consistent push can do.

The parameters included in the above-given image are-

1. Bollinger Band

2. Moving averages

3. VWAP

4. MACD

5. RSI

6. OBV

Now this certainly pushes me to mention a very important possibility of what is called “Analysis Paralysis”

Analysis paralysis describes an individual or group process when over analyzing or overthinking a situation can cause forward motion or decision-making to become “paralyzed”, meaning that no solution or course of action is decided upon. Wikipedia

With so many parameters one certainly can overthink and overdo but, that’s what will distinguish a good trader with a not so good trader.

As I always keep mentioning, there’s no bad trader of no bad trade’s- there are good trades and if not then there are good lessons teaching trades.

What I aim to achieve with understanding as many indicators as possible is the development of instinct and temperament.

By understanding the logic behind each indicator (which in my opinion is the more important the actual signal suggested), the reader starts developing an instinct via experience. Also, if done correctly, it helps to chop down potentially dice trades which then might better suit a trader’s risk appetite.

Also on #Day 4, I increased my very first part of a company (TATASTLBSL) by 10 more shares.

With this now I am a proud owner of TATASTLBSL as I own approximately 1.005 x 10-6 % of the company. (As on 30-06-2020, the company has a total of 1,093,439,768 shares outstanding.)

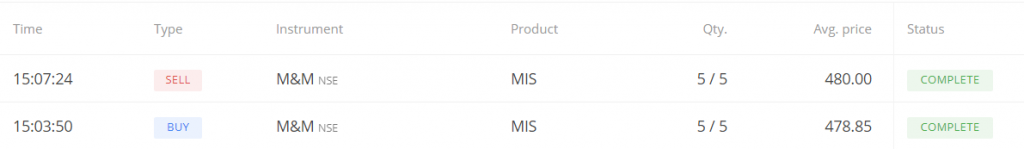

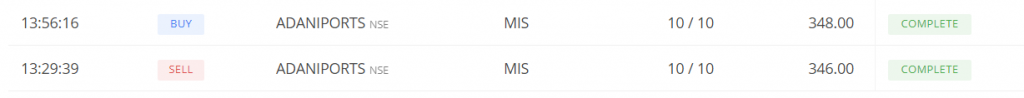

On Day 4 itself, I bore a loss and also mitigated it via another potentially profitable trade. What important learning that I should pull away from this intraday up and down is “PATIENCE” because for I had been patient- I could have avoided the loss in first place followed by no need for the second trade buying me the most important resource of trading (and life) that is- TIME. I could have simply been patient and had a better trade if I could have had a better understanding, experience, and temperament.