Before writing this blog, I want to express one personal feeling of mine- I feel more productive and involved in the stock market the earlier I wake up and be a part of intraday than any time late.

I am “one of those” who can stay up till 4 am and wake up at 12 noon, also “one of those” who can sleep at 1 am and still wake up at 12-noon xD

So instead I choose the former one, which certainly is not what I want to continue and will soon start reading: The 5 am club. By- Robin Sharma (I’ll write a blog on this as well)

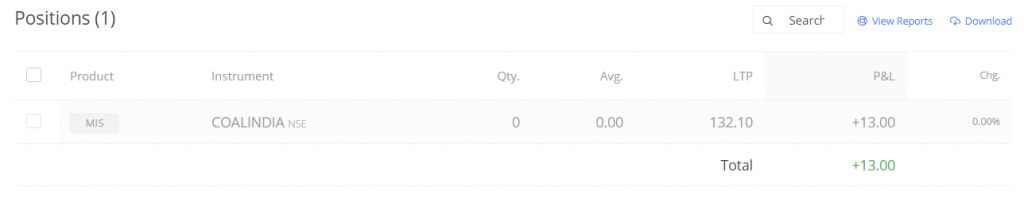

So continuing with the blog, I woke up and joined my intraday action late, very late in fact somewhere around 12:30 pm. Now as expressed, this does not feel the best but I went on with my analyzing promising to stick to basics and not to take a trade which does not seem fruitful. Though I managed to be profit (a minor one again xD Rs. 13.00 to be precise) in my opinion, being more disciplined on my starting time would have definitely helped positively and I could surpass my minor pluses and minuses benchmark deal, that I’m up to as a beginner, with greater efficiency.

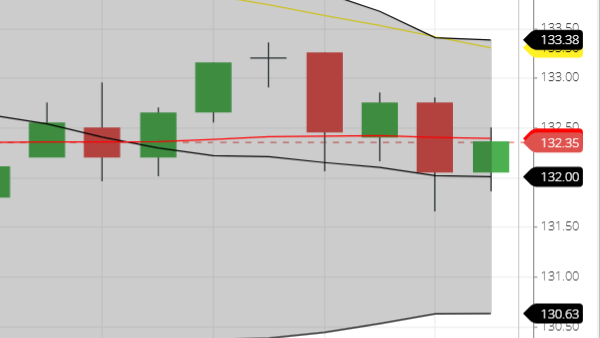

I took a intraday long trade (buy first) of the stock COALINDIA. I bought 20 shares as soon as I saw a positive indication from the VWAP indicator. Note: Here the volumes were not the best (can be termed as neutral on the best day). Neither was the RSI indicating something very positive (with reference to overall market that day) but I decided to go for it- again something that I can learn from. I could have been more ‘patient’. But that’s just somehow contrary to the dynamic behavior of intraday where grabbing an opportunity immediately is very important. I think- the sweet spot is what the best traders hit for and achieve.

I bought 20 units at a buy price of 132.40 at time 13:18:32 and sold at a selling price of 133.05 at the time 14:22:39. Now it’s note worthy that I sold off in a hurry, purely based on intuition and it turned out to be the best case actually.

I made the buy at the first green candle visible in the above image and managed to exit at the top of the green candle on the left of the doji (the + shaped candle) and it turns out that this was the best time to square off long as it was followed by a downtrend closing below my buy price.

Also, I’ve read that market volatility is best to be captured between 10 am to 12:30 pm or around a similar time. I kind of feel the same with the experience I have had till now and will try to tap that time more effectively in upcoming trading sessions.

Key takeaways:

1. Wake up on time and start early.

2. Do NOT rush in trades. But do not miss opportunities either. Hit the sweet spot.

3. Intuition is good. Good when it’s profitable. It has to be developed A LOT more by experience before being trusted on.