Today morning at 09:00 I had to leave for personal work with my dad. So, all my trading activities- viewing charts, placing orders, and surveilling ups and downs- were all done on a mobile app- Zerodha Kite.

Both of the trades were based on VWAP and volume indications.

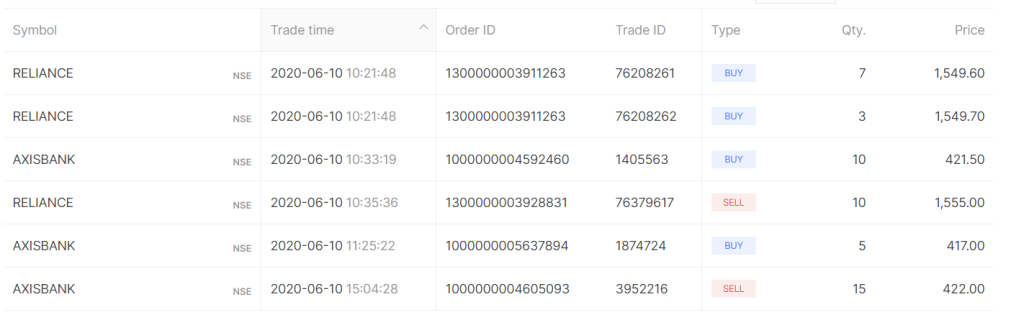

I bought 10 shares AXISBANK at 421.50. Now after initiating the trade (Note: I had taken a intraday long trade with positive indications from VWAP + MACD + Good volumes) and it still started going downhill.

Now, learning from Day #4, patience is something very important. I kept my head straight and in fact, saw this as a better buying opportunity.

So I bought 5 more shares of AXISBANK, this time at 417.00 per share, reducing my average cost per share to 420.00 per share.

Before buying this trade, with VWAP and Volumes indication, I went long on RELIANCE at an average price of 1549.63 (I bought at market price, so got 7 shares for 1549.6 and 3 shares for 1549.7 averaging to 1549.63) and also set immediate sell orders with limit (target) of 1555.

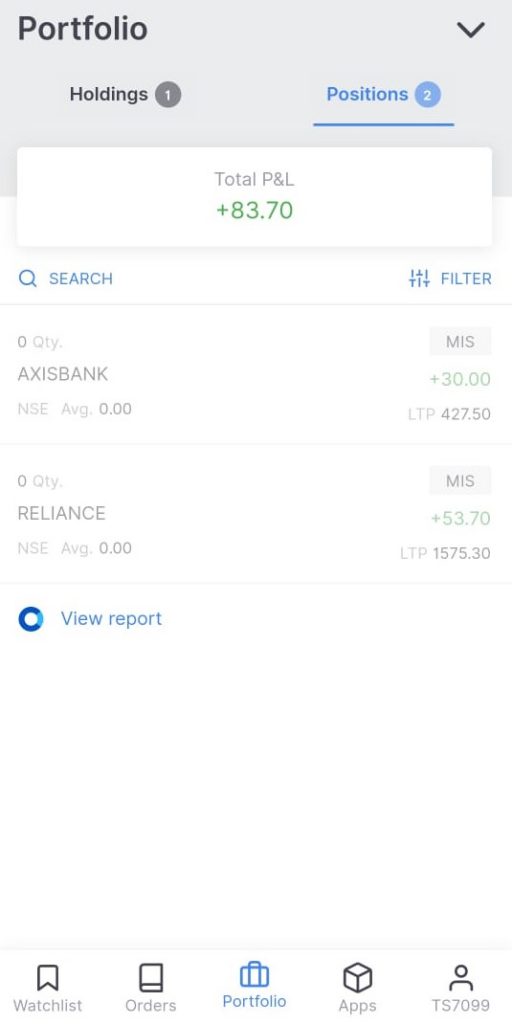

Coming back to AXISBANK trade where I bought more when the trade moved in the opposite direction to my expectation, I managed to square off all 15 positions of mine at Rs. 422 giving me a profit of Rs. 2 per share for 15 shares.

Overall, in the entire day, I only viewed my phone 3 times.

- For buying RELIANCE and AXISBANK

- For buying more AXISBANK when I was sure of the market direction.

- For selling AXISBANK on which I had not placed a simultaneous taget.

So basically, with investing less than 1 hour in the entire day, I managed a total profit of Rs. 83.70. Not that bad huh!

In fact, this was my first day trading off my laptop and making my first exhibit able (2 digit xD) profit and I am very proud of it 🙂

Key takeaways were-

1. Somehow trading less made me worry less made me more profits.

2. I didn’t have to trail the trade and trail my profits and losses. Actually, this is more helpful than trailing it continuously.

3. I was forced to set some profit and loss margins, and be off screen until one or the other is triggered. This in my opinion is the style of intraday I want to hold on to even when my screen is readily available.